Greens warn of over €1.5bn loss to State if rezoning levies issue not remedied

Mon, Dec 9, 2019

Read in 3 minutes

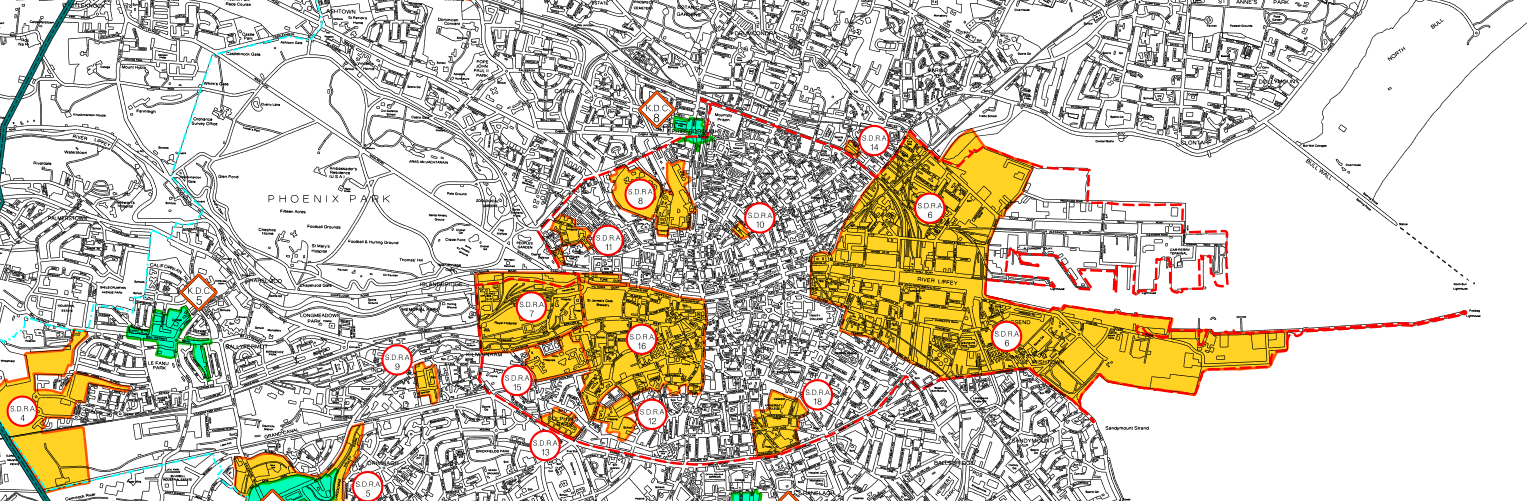

The Green Party has called for the reinstatement of an 80% ‘windfall tax’ on lands rezoned for housing purposes. It has warned that the State could lose out on over €1bn in revenue if it fails to take action. The call comes as a new report prepared by Dublin City Council suggests that 325 hectares of industrial lands in Dublin’s inner suburbs may be rezoned to allow for housing.

Green Party MEP for Dublin Ciarán Cuffe said: “It would be madness if the State were to miss out on €1.5Bn in rezoning levies due to a flawed Fine Gael decision. Back when the Green Party was in Government we ensured that an 80% tax was put in place on land zoning profits. This helped to curb speculation by imposing a tax on profits from land rezoning. However Fine Gael under pressure from developers repealed this part of the NAMA legislation. The provisions were contained within Section 649 B (3) of the National Asset Management Agency (NAMA) Act 2009, but were terminated by Fine Gael with the passage of Section 31 A (ii) of the Finance Act 2014.

“Dublin City Council is proposing rezoning certain lands such as the Dublin Industrial Estate located by Broombridge Junction on the Luas Cross City line. This is a golden opportunity to provide affordable housing beside high quality public transport links. However, without the rezoning tax the lands will increase significantly in value once rezoned and the bulk of the profit will go to the developer rather than the State. This means less affordable housing.

“Back in 1973 the Kenny Report urged the State to ensure windfall profits from development did not go to speculators. One of the few measures in recent times that ensured this could happen was repealed five years ago by Fine Gael. It is time to reinstate it. Fine Gael must ensure rezoning profits go to the State rather than line speculators’ pockets.”

Councillor for Cabra-Glasnevin and Green Party Finance spokesperson Neasa Hourigan said: “The huge profits made by property developers during the boom in the 2000s due to the rezoning of land by local authorities led to a highly politicised process and poor regional planning decisions. A windfall tax still allows property owners to realise a significant profit while ensuring the price of land for housing remains reasonable.

“At Dublin City Council’s last monthly meeting Assistant Chief Executive Richard Shakespeare proposed the rezoning of 325 hectares. This will double the value of the land perhaps from €6m to €12m a Hectare. If the 80% windfall tax were in place the State would accrue over €1.5billion. It would be shameful if the State was to lose out on this revenue from rezoning. Failing to act will continue to make housing unaffordable in Dublin City.”

ENDS

Note:

Dublin City Council Report 82 / 2019 “Update on Review of Industrial Lands (Z6/Z7) in the City”. 19Feb19 Dublin City Council Report 311 / 2019 “Update on Industrial Lands Study and Proposed Draft Variation of Dublin City Development Plan 2016-2022”. 23Oct19

For more information contact:

Ian Carey

Communications Manager

E: mailto:press@greenparty.ie

T: +353 1 636 9282

M: +353 85 256 3552